It’s a normal work day until a car recklessly turns into your lane and hits your commercial vehicle. When you both pull over to exchange insurance, they’re holding their neck and shouting at everyone nearby that you hit them.

You are the victim of a staged accident.

As the police pull up, the other driver eagerly tells them a tall tale about how you “came out of nowhere and hit them”. They go on to insult your competence and claim that you may have been sleeping behind the wheel.

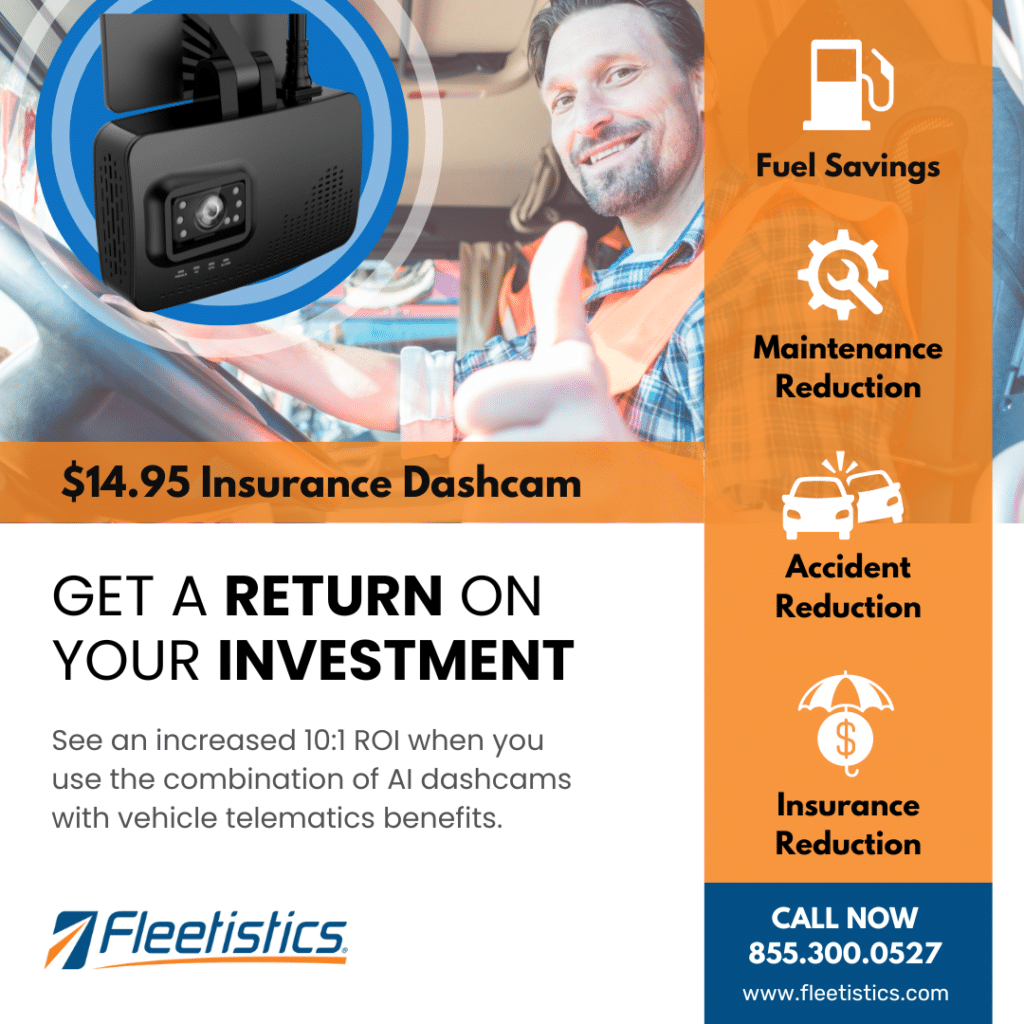

When the officer approaches you, you inform him that you have a telematics system, including a dashcam that captured what happened, and you are not at fault.

This is how you protect your commercial vehicles from a staged accident.

Criminals look for drivers they believe are well-insured or easy targets and create elaborate plans to make an accident appear to be your fault. The scene can be so convincing that everyone sides with them, and your insurance has to pay for their “injuries” and vehicle damage.

What is Insurance Fraud?

Insurance fraud is a serious threat for anyone, but businesses have more to lose. According to the National Insurance Crime Bureau, commercial vehicles are a prime target because they are more likely to be covered by a quality insurance plan. Knowing your driver is well-insured provides criminals with the perfect recipe to make a fraudulent insurance claim or sue your business.

Some businesses have even removed branding from their vehicles altogether to protect their drivers! But in some jurisdictions, commercial vehicles are required by law to display the company name,business license number.

Who are the Frauds?

You may be surprised by who actually commits something like a staged accident! They are not performed by a con man faced with poverty but white collar business women and men.Â

The FBI states that fraud (like a staged accident) is often practiced by an organized group of attorneys, medical practitioners, and insurance brokers, agents, or executives. These criminals are closely connected with insurance claims and can leverage the system to make money. Occasionally, repair shop owners will participate in this type of scheme too.

This is why the FBI also suggests that you should be wary if a stranger approaches you at the accident site and recommends a certain attorney or suggests that you seek medical attention from a specific doctor. These are warning signs that you are involved in a staged accident.

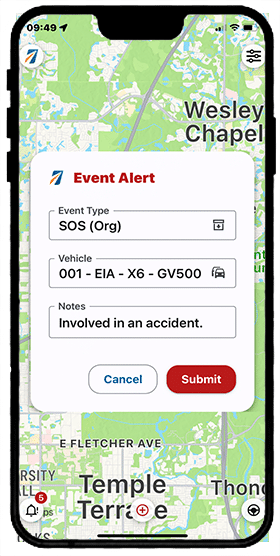

How Does Telematics Systems Protect Against a Staged Accident?

There are many areas that might be left open to interpretation during the claims process, either due to misunderstanding or fraud. However, the data that GPS tracking and telematics software provide will paint a clear picture for law enforcement and your insurance company.

So, what type of information can telematics systems offer up as evidence in the case of a staged accident?

- Speed

- Acceleration

- Brake Data

- Cornering

- Vehicle Position

- GPS Location

- Seatbelt On/Off

- Engine Status

- RPM

- Date

- Time

- In Cab Video Footage

- Dash Cam Video Footage

Fleet tracking technology and software are used in collision reconstruction to better understand the events that took place before, during, and after a collision occurs. Because telematics data is science, it is extremely valuable.

Through real-time monitoring of vehicle and driver data, telematics systems offer businesses hard evidence surrounding an accident. The information recorded becomes a crucial tool to protect your drivers and your company.

Preventing Accidents with Safe Practices

Although there are times when we can’t avoid an accident, the risk of being involved in a staged accident can be diminished with defensive driving tactics and safe practices. Good driving behavior can prevent a collision in most cases, even when criminals are plotting against you.

Catching your driver’s bad behavior before it results in an accident and correcting it is key.

Telematics data that are recorded and reported to your fleet management team may include:

- Tailgating

- Cell Phone Use

- Hard Braking

- Hard Cornering

- Fast Acceleration

- Speeding

Through driver coaching or training, your company can build a safe driving team that rarely experiences accidents, whether they are staged or not. With the Fleetistics GO Talk coaching system, our technology speaks directly to your driver to curb bad behavior on the spot! Make your messages as serious or playful as you want to, depending on your teaching style. Or use our automatic feedback buzzer as a simple warning.

GPS Tracking and Telematics Systems for Businesses in Tampa Bay, Florida, and Beyond

Quick overturns and training classes can be expensive. Cut your costs and gain employee loyalty by developing your team and protecting them. Teach drivers how to be safe without hovering over their shoulder, and defend them when they are the target of fraud with Fleetistics help!

If you live in the Tampa Bay area and own commercial vehicles, you need to learn more about Fleetistics GPS Tracking and Telematics Systems. Contact us today to discover what we can do to help protect you from a staged accident.