When your company vehicles are loaded with telematics technology, it opens up a world of possibilities. Telematics does not only help businesses watch employee behavior. GPS tracking and video recording options can add additional driver safety!

You wonder how driver safety factors in? Imagine this: A terrible storm strikes the coast of Florida while you have vehicles on the road. All but one return. You call the driver and no one answers the phone.

What do you do?

If you didn’t have telematics software installed in the vehicle, there is very little that you can do besides calling the police and hoping for the best. But with GPS tracking, you can find the vehicle’s exact location and the driver inside.

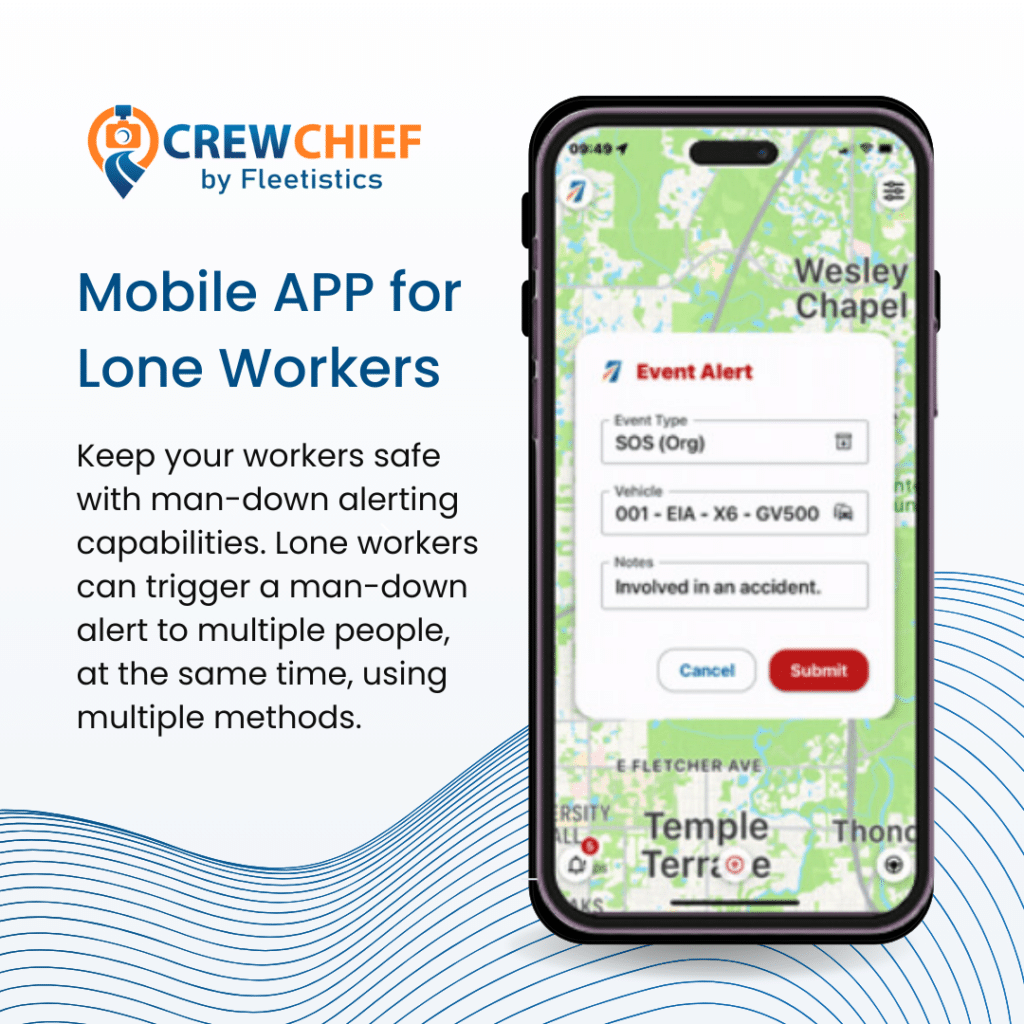

Many people have been successfully rescued from life-or-death situations when every precious minute matters. Whether they are suffering from a heart attack or caught in a natural disaster, knowing where your drivers are is crucial.

But there are many other reasons why telematics software can increase driver safety. Let’s take a look at a few of the most important.

Accidents

No one wants to fall asleep behind the wheel, but it happens. Even when we are alert and careful, accidents can still occur. And whether it’s our fault or not, being able to walk away from a crash is a privilege; not everyone is that lucky. That’s why driver safety is so imperative!

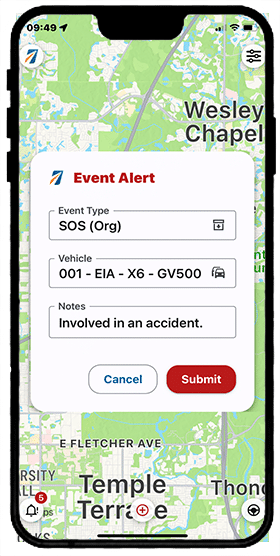

If your driver is incapacitated after a hit-and-run or if he or she goes off the road and is too injured to phone 911, telematics can alert your office, so they can quickly dispatch emergency personnel to the location.

Correcting Dangerous Behavior

Your employees may not like it when you notice that they are not wearing their seat belts or they are not braking enough, but correcting bad driving habits and discourteous behavior adds to driver safety because it can prevent accidents and save lives.

You can use telematics data and camera footage as evidence to reinforce rules for your drivers and remedy potentially lethal mistakes before they cause an accident. Reward safe drivers and achieve increased driver safety by encouraging safe driving behaviors and practices.

Telematics Intel for Enhanced Driver Safety

Your company vehicles, just like your phone, can track their current location, location history, and a chronology of your travels. It has the ability to determine when your vehicle is driven, where it goes, its speed, and whether it’s accelerating too fast or the brakes are hit too hard. Even cell phone or seatbelt use can be recorded!

Businesses that include telematics software are focused on driver safety for their employees, as well as their performance. This, in turn, improves driver retention rates, increases morale, and makes each driver feel motivated to be their personal best, especially with the addition of new incentives.

Driver Safety plus Attractive New Incentives

Driver safety is critical for fleet businesses, and both insurance companies and the government know it. When you demonstrate that you are taking every step possible to ensure that your employees drive safely, they reward you with new incentives.

If saving money on the bottom line is important to you, read on to learn about how you can write off telematics on your taxes and reduce your insurance premiums.

Lower Insurance Premiums

A new fleet driver may be considered a risk by insurance providers, and as a result, the premiums for newly employed drivers are expensive! Until they demonstrate that they are safe drivers, these rates are likely to stay higher in cost.

Businesses are eager to reduce their insurance costs. They don’t want to put blind faith in drivers and play the waiting game.

But is there another option?

Yes!

Even new drivers can save on their auto insurance with telematics.

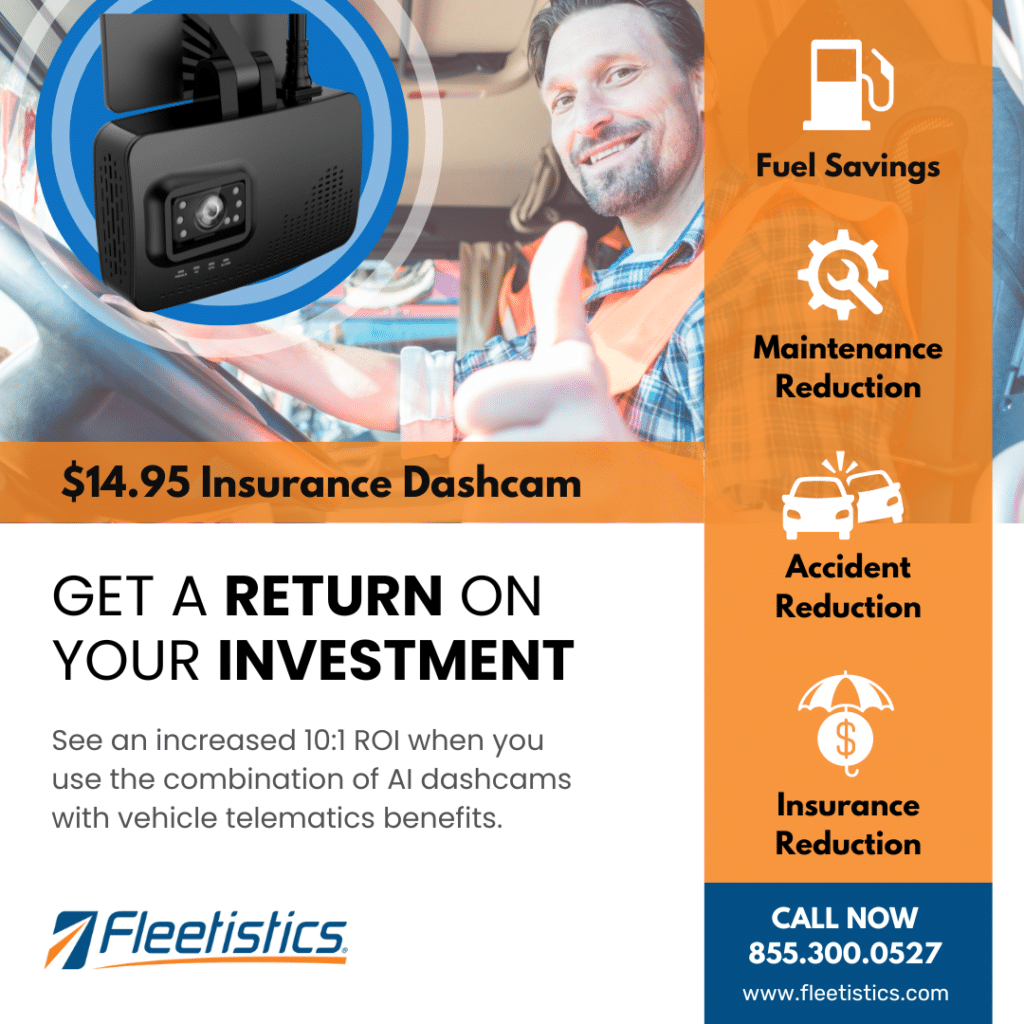

To help new employees become more efficient and safe drivers, fleet owners can choose to install fleet telematics hardware and use the software to provide actionable reports. When combined with dash cams, driver behavior can be even better documented.

Insurance agencies commend these technologies and recognize their success in enhancing driver safety and preventing fraud. When insurances are made aware that your fleet is using telematics systems, they may offer you a lower premium right away. This is something you will need to shop around for.

Telematics may also come into play if the insurance policy that you have purchased from your provider is dependent on mileage.

Not only will a fleet telematics system improve your driving team’s overall performance on the road, but in the event of an accident, the evidence recorded can prove your driver innocent or guilty.

Tax Break Incentives

Company vehicle owners can find innovative ways to save expenses while remaining competitive with telematics technology! They can boost operational efficiency and help your business to meet the requirements to qualify for tax breaks.

GPS tracking and telematics systems are getting a lot of attention from businesses because of this potential.

But you need to have a strong grasp of the tax codes and do your own research if you want to maximize your savings.

Qualified Fleetistic equipment may make your business eligible for the Section 179 deduction. Under Section 179, small businesses can write off the entire purchase price of certain equipment and technology within the first year of purchase.

For more information, use the link above to learn more. There is a good chance that you can receive compensation for your investment.

Also, there are fuel tax credits available for vehicles that operate off-road. Telematics can help you to document off-road vs on-road miles driven.

Taking Advantage of New Incentives

One of the most critical components of fleet management is ensuring that all drivers and vehicles are safe. The government and insurance companies know this and they encourage you to use telematics to ensure the safety of your team.

Insurance price reductions, fuel tax credits, and tax reductions are there for your company to take advantage of, so why aren’t you? Reduce your fleet insurance premiums and minimize your tax burden with Fleetistics telematics today!

This blog post series about the benefits of telematics will conclude with the next part. Stay tuned! And if you would like to take another look at our previous posts about this subjects, feel free to do it here: